Disaster Alert

August 31, 2023

Source: MSN/Newsweek; National Hurricane Center

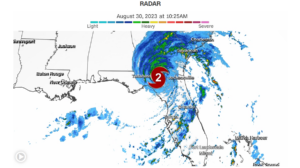

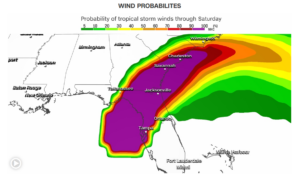

Hurricane Idalia has been downgraded to a tropical storm after making landfall in Florida on Wednesday and tearing across the northern portion of the state and into Georgia and South Carolina, leaving destruction and flooding in its wake.

According to the latest tracking by the National Hurricane Center, as of 2 a.m. ET, the storm was still circulating along the coast of South Carolina, and is expected to move northwards, impacting parts of the North Carolina coastline, before arching back out into the Atlantic Ocean by 8 p.m. on Thursday.

In North Carolina, Governor Roy Cooper told residents to “batten down the hatches for a little while” in a press conference on Wednesday, as he authorized the deployment of the state’s National Guard to worst-affected areas.

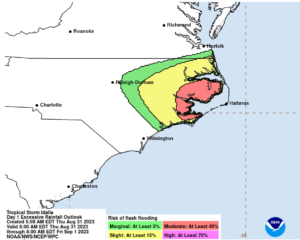

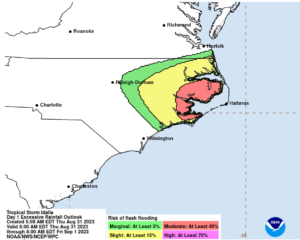

A forecast map produced by the National Hurricane Center shows the greatest risk of flash flooding is now in eastern North Carolina, between Wilmington and Hatteras, where there is a 40 percent chance of a deluge across Thursday.

A large swathe of South Carolina still faces a 5-15 percent chance of excessive rainfall leading to flooding, and the risk of flash flooding across northern and western Florida—including Tampa Bay and the areas surrounding Tallahassee—is expected to persist until Saturday.

Western coastal regions of Florida saw storm surge flooding ahead of Idalia’s arrival, while it was still a Category 4 hurricane in the Gulf of Mexico. Storm surge is a rise in the sea level beyond tidal changes that precede the arrival of an impending storm and can cause severe flooding as seawater breaches coastal defenses.

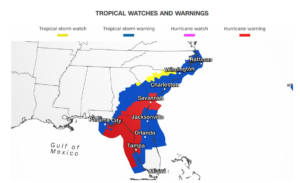

The potential for storm surge flooding is now far more limited, with the coastline of the Carolinas between Jacksonville, South Carolina, and the Pamlico Sound in North Carolina predicted to see several feet of surging sea water, as of 11 p.m. ET on Wednesday.

The area between Savannah and Myrtle Beach is likely to see the worst storm surge flooding, National Hurricane Center maps show, with seawater rising to in excess of six feet above localized ground levels in parts. Meteorologists at the agency give a one in 10 chance of storm surge reaching such levels.

As of 2 a.m. ET on Thursday, though, the only part of the East Coast under a storm surge warning was the interior coastline of Pamlico Sound.

In Charleston, South Carolina, storm surge flooding overcame the sea wall, pouring ankle-height water onto the city’s streets, the Associated Press reported.

The National Weather Service (NWS) said in its latest forecast that the tropical storm was interacting with the coastline and still producing “very heavy precipitation over portions of South and North Carolina.”

It added that because Idalia was “fairly close to the coast,” with much of its circulation occurring over water, “not much additional weakening is anticipated.” Cyclones feed on warm seawater and typically degrade rapidly over land.

However, NWS meteorologists said that its continued interaction with the coast will likely prevent it from strengthening again as it moves out into the Atlantic later in the week—suggesting subsequent coastal impacts may be limited.

“Although it seems likely that the cyclone will move rather slowly in the two-five day time frame, the details of its track are uncertain due to significant track model differences in the latter part of the forecast period,” the NWS cautioned.

Newsweek approached the NWS station in Raleigh, North Carolina, via email for comment on Thursday.

Despite leaving a path of destruction in its wake, officials have yet to confirm any deaths directly due to the impacts of Idalia. Two people were killed in hurricane-related car crashes in Florida ahead of the storm’s arrival, the state’s highway patrol said, according to numerous reports.

***Note: FEMA has approved an Emergency Management Declaration for Tropical Storm Idalia, but has not issued a Major Disaster Declaration at this time. We will update you as more information becomes available.***

To order an inspection, please log-in to your SafeView Access account.